Your 1031 exchange foreign real estate images are ready. 1031 exchange foreign real estate are a topic that is being searched for and liked by netizens now. You can Get the 1031 exchange foreign real estate files here. Find and Download all free photos and vectors.

If you’re searching for 1031 exchange foreign real estate pictures information related to the 1031 exchange foreign real estate interest, you have come to the right site. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

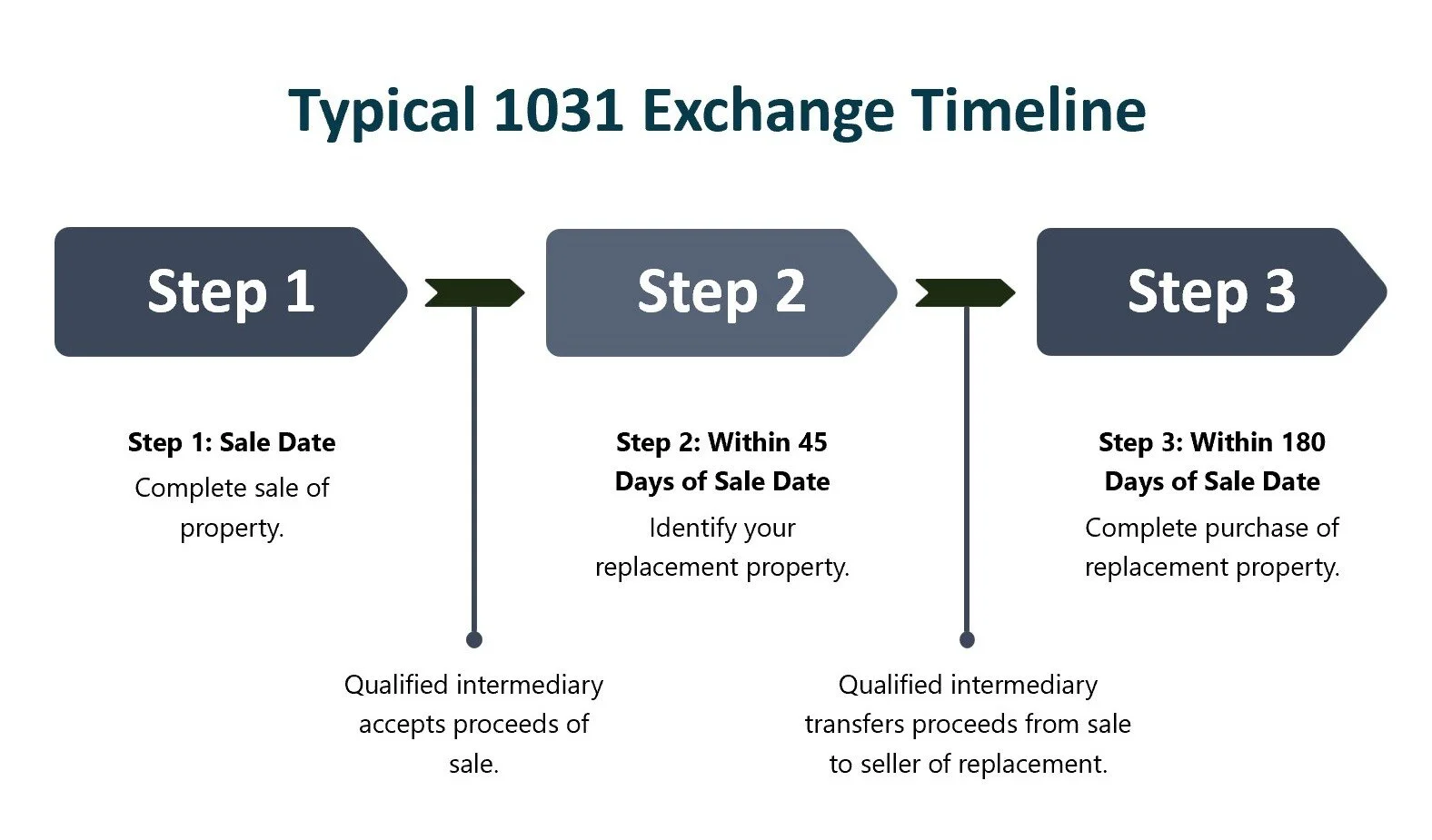

1031 Exchange Foreign Real Estate. Then provide notice to your buyer and apply for your withholding certificate if applicable. Tax code that allows for investment property real estate or otherwise to be exchanged for similar investment property. Its a common misconception among foreign real estate investors that they can bypass FIRPTA withholding by participating in a 1031-Exchange. The first thing to do is to consult with a professional tax advisor to verify if FIRPTA applies.

Firpta 1031 Exchange And More A Brit S Real Estate Investing Guide Purser Tax From pursertax.com

Firpta 1031 Exchange And More A Brit S Real Estate Investing Guide Purser Tax From pursertax.com

Finally any foreign seller should seek independent legal tax or financial counsel from experienced advisors to assist them with the closing and US. You must exchange your foreign property for another foreign property or properties. A 1031 exchange of foreign real estate allows you to exchange one foreign property for another with the same tax benefits. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. Below are links to the documents necessary to file for an exemption. Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits.

Foreign seller wishing to complete a 1031 exchange consult with a knowledgeable professional qualified intermediary early in the sale process.

Property or visa versa. 1 the closing of the relinquished property must occur simultaneously with the purchase of the replacement property. In a 1031 exchange foreign real and personal property when exchanged for foreign real and personal property qualify for a federal capital gain tax deferral. Then provide notice to your buyer and apply for your withholding certificate if applicable. A 1031 exchange allows real estate investors to essentially swap one property for another. Foreign investors can still take advantage of IRS 1031 to execute a tax-deferred exchange using the third exception above but it takes up-front planning.

Source: garybuyshouses.com

Source: garybuyshouses.com

However in order to use the process investors have to meet. A 1031 like-kind exchange is a part of the US. Tax code provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. However the Foreign Investment in Real Property Tax Act of 1980 FIRPTA can significantly complicate a 1031-Exchange process for foreign investors. Then provide notice to your buyer and apply for your withholding certificate if applicable.

Source: brg-cre.com

Source: brg-cre.com

Exchangers may freely exchange properties throughout the United States trading property in one state for replacement property in another state. A 1031 like-kind exchange is a part of the US. Real property can be any real property given the nature and character of rights of the exchange properties are essentially alike including likeness of physical properties character of title conveyed rights of the parties and duration. Like kind properties are real estate assets that qualify under Section 1031 of the Internal Revenue Code for exchange and for the deferment of capital gains taxes. Foreign investors can still take advantage of IRS 1031 to execute a tax-deferred exchange using the third exception above but it takes up-front planning.

Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits. The first thing to do is to consult with a professional tax advisor to verify if FIRPTA applies. In a 1031 exchange foreign real and personal property when exchanged for foreign real and personal property qualify for a federal capital gain tax deferral. A 1031 Exchange is one of the exceptions for withholding if doing a 1031 Exchange the taxpayer should immediately file the 8288-B form. That means investment real estate for investment real estate.

Source: pursertax.com

Source: pursertax.com

Like kind properties are real estate assets that qualify under Section 1031 of the Internal Revenue Code for exchange and for the deferment of capital gains taxes. Before I get into the details of a 1031. Property located in the US Virgin Islands and Guam is considered to be in the United States. IRC 1031 Exchanges of foreign real estate - by Bill Lopriore You can trade real estate located in any state in the US. 1031 Exchanges for Foreign Real Estate Investors Whenever you sell a business or investment property and you have a gain you generally have to pay tax on the gain at the time of sale.

Source: origininvestments.com

Source: origininvestments.com

A 1031 Exchange is one of the exceptions for withholding if doing a 1031 Exchange the taxpayer should immediately file the 8288-B form. You must exchange your foreign property for another foreign property or properties. A 1031 exchange allows real estate investors to essentially swap one property for another. However you can sell a foreign property and reinvest the proceeds in a new foreign property and defer all. Exchanges of Real property located outside the US.

Source: manhattanmiami.com

Source: manhattanmiami.com

Then provide notice to your buyer and apply for your withholding certificate if applicable. Real estate for real estate located in Guam the Northern Mariana. In a 1031 exchange foreign real and personal property when exchanged for foreign real and personal property qualify for a federal capital gain tax deferral. Real property can be any real property given the nature and character of rights of the exchange properties are essentially alike including likeness of physical properties character of title conveyed rights of the parties and duration. If you are a foreign seller you should determine if an exemption or reduction is applicable to your transaction.

Source: taxesforexpats.com

Source: taxesforexpats.com

Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. 11031h and will not qualify for tax deferral if foreign property is exchanged for US. The first thing to do is to consult with a professional tax advisor to verify if FIRPTA applies. 1031 Exchange of Foreign Real Estate Tax Considerations.

Source: commercialpropertyadvisors.com

Source: commercialpropertyadvisors.com

In a 1031 exchange foreign real and personal property when exchanged for foreign real and personal property qualify for a federal capital gain tax deferral. You must exchange your foreign property for another foreign property or properties. The Internal Revenue Code specifically notes that property located in the United States cannot be exchanged for property located outside the country under Section 1031. 1 the closing of the relinquished property must occur simultaneously with the purchase of the replacement property. Below are links to the documents necessary to file for an exemption.

Source: nomadcapitalist.com

Source: nomadcapitalist.com

Heres what you must do to ensure that the transaction qualifies as an offshore 1031 exchange after you sell your foreign real estate property. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. That means investment real estate for investment real estate. Property Owned Overseas Exchange. 3 the seller must notify the buyer that the seller is not required to recognize any gain or loss and.

Source: blog.craftcommercial.com

Source: blog.craftcommercial.com

Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits. In certain circumstances you can trade US. Tax code provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. Real property can be any real property given the nature and character of rights of the exchange properties are essentially alike including likeness of physical properties character of title conveyed rights of the parties and duration. For real estate located in that same state or any other.

Source: legal1031.com

Source: legal1031.com

Its a common misconception among foreign real estate investors that they can bypass FIRPTA withholding by participating in a 1031-Exchange. A 1031 like-kind exchange is a part of the US. Property located in the US Virgin Islands and Guam is considered to be in the United States. Like kind properties are real estate assets that qualify under Section 1031 of the Internal Revenue Code for exchange and for the deferment of capital gains taxes. Before I get into the details of a 1031.

Source: blog.firstam.com

Source: blog.firstam.com

Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits. A 1031 exchange of foreign real estate allows you to exchange one foreign property for another with the same tax benefits. However the Foreign Investment in Real Property Tax Act of 1980 FIRPTA can significantly complicate a 1031-Exchange process for foreign investors. That means investment real estate for investment real estate. Property Owned Overseas Exchange.

In certain circumstances you can trade US. Property Owned Overseas Exchange. Below are links to the documents necessary to file for an exemption. 2 there can be no boot in the exchange. Foreign investors can still take advantage of IRS 1031 to execute a tax-deferred exchange using the third exception above but it takes up-front planning.

Source: truesouthcoastalhomes.com

Source: truesouthcoastalhomes.com

You can exchange a piece of factory equipment for another piece of factory equipment or you can exchange a commercial building for a residential apartment building. In order for the sale of the relinquished property in a 1031 exchange to be exempt under current regulations. IRC 1031 Exchanges of foreign real estate - by Bill Lopriore You can trade real estate located in any state in the US. Are like-kind for purposes of the like-kind exchange rules under 1031. Like kind properties must be held for business or investment purposes only not for private use.

Source: nestapple.com

Source: nestapple.com

However the Foreign Investment in Real Property Tax Act of 1980 FIRPTA can significantly complicate a 1031-Exchange process for foreign investors. In a 1031 exchange foreign real and personal property when exchanged for foreign real and personal property qualify for a federal capital gain tax deferral. A 1031 like-kind exchange is a part of the US. Property or visa versa. However you can sell a foreign property and reinvest the proceeds in a new foreign property and defer all.

Source: nestapple.com

Source: nestapple.com

Foreign real property and real property situated in the United States are not considered like-kind per Treasury Reg. However you can sell a foreign property and reinvest the proceeds in a new foreign property and defer all. That means investment real estate for investment real estate. If you are a foreign seller you should determine if an exemption or reduction is applicable to your transaction. In order for the sale of the relinquished property in a 1031 exchange to be exempt under current regulations.

Source: 1031exchange.com

Source: 1031exchange.com

However foreign real property is not like-kind to United States real property which is limited to the 50 states and the District of Columbia IRC 1031. Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits. However the Foreign Investment in Real Property Tax Act of 1980 FIRPTA can significantly complicate a 1031-Exchange process for foreign investors. IRC 1031 Exchanges of foreign real estate - by Bill Lopriore You can trade real estate located in any state in the US. Tax code that allows for investment property real estate or otherwise to be exchanged for similar investment property.

Source: youtube.com

Source: youtube.com

Finally any foreign seller should seek independent legal tax or financial counsel from experienced advisors to assist them with the closing and US. Property or visa versa. 4 the buyer must provide within 20 days. Why would I need Foreign Exchange for real estate assets overseas. Exchanges of Foreign Property.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 1031 exchange foreign real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.