Your 100 joint venture financing real estate images are ready. 100 joint venture financing real estate are a topic that is being searched for and liked by netizens today. You can Find and Download the 100 joint venture financing real estate files here. Get all free vectors.

If you’re searching for 100 joint venture financing real estate images information connected with to the 100 joint venture financing real estate keyword, you have visit the ideal site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

100 Joint Venture Financing Real Estate. A joint venture in real estate is two or more parties that combine resources for a specific development or investment. A joint venture property development finance is a business arrangement between two or more parties that agree to combine some of their resources for a particular purpose. 100 equity financing Select Projects Only Typically three to five year term Non-recourse financing No interest payments during term of investment Minority equity stake in lieu of interest Take out with permanent financing or sale Time to Closing. 5 Benefits to using a Mortgage Broker.

The Meeting That Showed Me The Truth About Vcs Techcrunch From techcrunch.com

The Meeting That Showed Me The Truth About Vcs Techcrunch From techcrunch.com

What is a joint venture JV in real estate. How are you able to provide 100 funding. Troubles Ahead for Commercial Real Estate Loan Refinancing By Damian Ghigliotty. Commercial Project Finance Joint Venture Lending Construction Hotels 100 Bond Equity Financing US Worldwide Experience prompt efficient approval and hassle-free access to the capital you need when you choose a commercial real estate loan from Edward Voccola Co. 7 Keys to Raising Joint Venture Equity. It may be time to Refinance.

Troubles Ahead for Commercial Real Estate Loan Refinancing By Damian Ghigliotty.

100 Joint Venture Funding 100 Combination Debt and Equity Funding 100 Equity Funding for 100 million and over large projects a niche program at its best We do. A joint venture property development finance is a business arrangement between two or more parties that agree to combine some of their resources for a particular purpose. Lending up to 70 of the completed value of the project. Work with the top financial intermediary in arranging joint venture equity for your project. How Does Joint Venture Real Estate Financing Work. How are you able to provide 100 funding.

Source: whitecase.com

Source: whitecase.com

Institutional Equity Private Equity Family Offices and High Net Worth Individuals. 90 to 120 days. This is a very impressive return compared to the real estate average of 20 to 30. Similar to a partnership but only for a specific project a joint venture is a contractual agreement between two or more parties to share in the costs profits and losses associated with the venture. In general a joint venture between a developer and financier involves a business deal wherein the two parties or more depending on the situation both agree to pool their resources in order to complete a real.

Source: techcrunch.com

Source: techcrunch.com

Structured joint venture financing maximizes cash flow potential for the borrower by including the lender as an additional investor in the project. We will create a state-specific entity to hold title to the property with a local management agreement in place to allow the borrower to manage the project and handle any other duties that are required while rehabbing the house. CFI has a source that can provide 100 equity financing that covers all project costs including. How Does Joint Venture Real Estate Financing Work. A joint venture in real estate is two or more parties that combine resources for a specific development or investment.

Source: techcrunch.com

Source: techcrunch.com

2 - 100 million plus. Joint Venture Financing Terms. Lending up to 70 of the completed value of the project. We Offer Joint Venture Real Estate Financing. Or on GBP 396.

Source: stessa.com

Source: stessa.com

The following is a summary of just one of the joint venture programs CFI has to offer. One hundred per cent property development finance or investment finance is a 100 finance facility tailored and provided to a sponsor that needs to raise almost the whole amount of finance to realise the project. We will create a state-specific entity to hold title to the property with a local management agreement in place to allow the borrower to manage the project and handle any other duties that are required while rehabbing the house. We offer mezzanine financing preferred equity development agreement structures and joint venture equity to our clients to determine and pursue the best execution for each real estate transaction. Interest only payments on loan.

Source: templatelab.com

Source: templatelab.com

We work with owners and operators across the country to help them capitalize their projects with LPGP equity from institutional funds family offices. We Offer Joint Venture Real Estate Financing. In the property sector developers will typically join forces to compensate for aspects of their project they lack in for instance finance. 7 Keys to Raising Joint Venture Equity. We can answer all your questions and help you get the funding thats right for your project.

Source: signa.at

Source: signa.at

Our innovative program allows us to work closely with each borrower as a credit partner. 100 financing of the purchase cost of improvements and soft costs. Houses 7 days ago A real estate joint venture is structured to help with the financing and ongoing development of projects in the real estate market. Mezzanine debt provides developers with subordinate debt funding up to approximately 90 of the value of the property. Joint Venture Property Development Finance.

Source: dzhyp.de

Source: dzhyp.de

What is a joint venture JV in real estate. 2 - 100 million plus. In general a joint venture between a developer and financier involves a business deal wherein the two parties or more depending on the situation both agree to pool their resources in order to complete a real. We work with owners and operators across the country to help them capitalize their projects with LPGP equity from institutional funds family offices. We offer mezzanine financing preferred equity development agreement structures and joint venture equity to our clients to determine and pursue the best execution for each real estate transaction.

Source: wallstreetprep.com

Source: wallstreetprep.com

It looks like interest rates are going up. Joint Venture Property Development Finance. In the property sector developers will typically join forces to compensate for aspects of their project they lack in for instance finance. This is a very impressive return compared to the real estate average of 20 to 30. How are you able to provide 100 funding.

Source: whitecase.com

Source: whitecase.com

5 Benefits to using a Mortgage Broker. There are different options to raise to 100 per cent development finance. Joint Venture Property Development Finance. A 60 loan and a 40 purchase of shares in project company. Commercial Project Finance Joint Venture Lending Construction Hotels 100 Bond Equity Financing US Worldwide Experience prompt efficient approval and hassle-free access to the capital you need when you choose a commercial real estate loan from Edward Voccola Co.

Source: techcrunch.com

Source: techcrunch.com

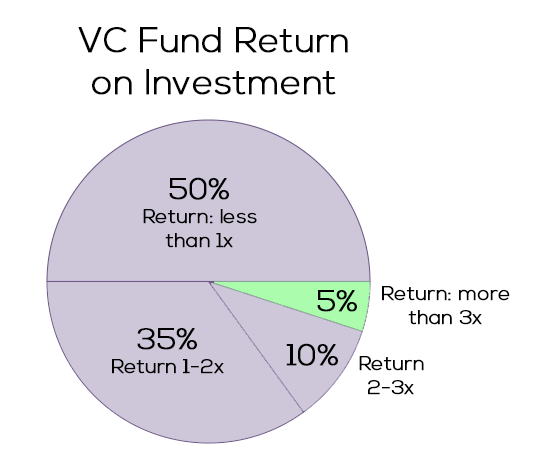

CFI has a source that can provide 100 equity financing that covers all project costs including. Joint Venture Return on Investment. It may be time to Refinance. CFI has a source that can provide 100 equity financing that covers all project costs including. How are you able to provide 100 funding.

Source: pinterest.com

Source: pinterest.com

A joint venture property development finance is a business arrangement between two or more parties that agree to combine some of their resources for a particular purpose. Work with the top financial intermediary in arranging joint venture equity for your project. The parties in a joint venture maintain their own business. If youre a real estate investor or fix and flipper interested in joint venture funding call the experts at Gauntlet Funding. The following is a summary of just one of the joint venture programs CFI has to offer.

Source: whitecase.com

Source: whitecase.com

CFI has a source that can provide 100 equity financing that covers all project costs including. What is a joint venture JV in real estate. We work with owners and operators across the country to help them capitalize their projects with LPGP equity from institutional funds family offices. JV Venture Capital Project Funding Program. Interest only payments on loan.

Source: whitecase.com

Source: whitecase.com

A joint venture in real estate is two or more parties that combine resources for a specific development or investment. Or on GBP 396. Venture Capital 6040 program to give 100 financing. Maximum term for loan 10 years. This program is attractive to developers who want to retain a greater share of the.

Source: templatelab.com

Source: templatelab.com

Or on GBP 396. Institutional Equity Private Equity Family Offices and High Net Worth Individuals. Joint Venture Property Development Finance. A joint venture in real estate investing is a way for investors to put their money experience and expertise together to accomplish more than they could on their own. Loan shall be exclusively used to acquire make improvements to subject property and to finance soft costs.

Source: gresb.com

Source: gresb.com

What is a joint venture JV in real estate. A 60 loan and a 40 purchase of shares in project company. This is a very impressive return compared to the real estate average of 20 to 30. Commercial Project Finance Joint Venture Lending Construction Hotels 100 Bond Equity Financing US Worldwide Experience prompt efficient approval and hassle-free access to the capital you need when you choose a commercial real estate loan from Edward Voccola Co. NEBO sources capital from over 1000 Joint Venture Equity entities including.

Source: whitecase.com

Source: whitecase.com

Joint Venture Return on Investment. Houses 7 days ago A real estate joint venture is structured to help with the financing and ongoing development of projects in the real estate market. Joint Venture Return on Investment. Or on GBP 396. To get started simply call us at 631-465-2161.

Source: whitecase.com

Source: whitecase.com

It may be time to Refinance. A joint venture in real estate investing is a way for investors to put their money experience and expertise together to accomplish more than they could on their own. Institutional Equity Private Equity Family Offices and High Net Worth Individuals. How are you able to provide 100 funding. Loan shall be exclusively used to acquire make improvements to subject property and to finance soft costs.

Source: wallstreetprep.com

Source: wallstreetprep.com

In the property sector developers will typically join forces to compensate for aspects of their project they lack in for instance finance. 7 Keys to Raising Joint Venture Equity. To get started simply call us at 631-465-2161. A joint venture in real estate is two or more parties that combine resources for a specific development or investment. It looks like interest rates are going up.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 100 joint venture financing real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.