Your 1 annual real estate tax illinois images are available. 1 annual real estate tax illinois are a topic that is being searched for and liked by netizens today. You can Find and Download the 1 annual real estate tax illinois files here. Download all free photos.

If you’re searching for 1 annual real estate tax illinois pictures information related to the 1 annual real estate tax illinois interest, you have come to the ideal site. Our website frequently gives you hints for seeing the maximum quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

1 Annual Real Estate Tax Illinois. If however the deed or trust document states that the real estate is. Part of the reason for the high property taxes in Illinois is that there are over 8000 different taxing authorities. Remember that in Illinois you pay taxes on the entire estate if it is above the 4 million threshold. The Fed is proposing a 1 annual tax be imposed already on top of the highest property taxes in the country.

This value is used to determine the proper tax that will be imposed on that property wwwrevenuestateilustaxinformation. How does the Illinois estate tax differ from the federal estate tax. Article 6 - Boards Of Review. The Fed is proposing a 1 annual tax be imposed already on top of the highest property taxes in the country. Title 1 - General. Sets forth a schedule of income-based tax rates for individuals trusts and estates for taxable years beginning on or after January 1 2021.

They propose that will stay in place for the next 30 years.

How does the Illinois estate tax differ from the federal estate tax. If however the deed or trust document states that the real estate is. Article 7 - Property Tax Appeal Board. Property tax is governed by the Property Tax Code 35 ILCS 2001 -1 through 32 20. The Fed is proposing a 1 annual tax be imposed already on top of the highest property taxes in the country. Senate Bill 689 repeals the Illinois Estate and Generation Skipping Transfer Tax for persons dying on or after July 1 2021 and for gifts made on or after July 1 2021.

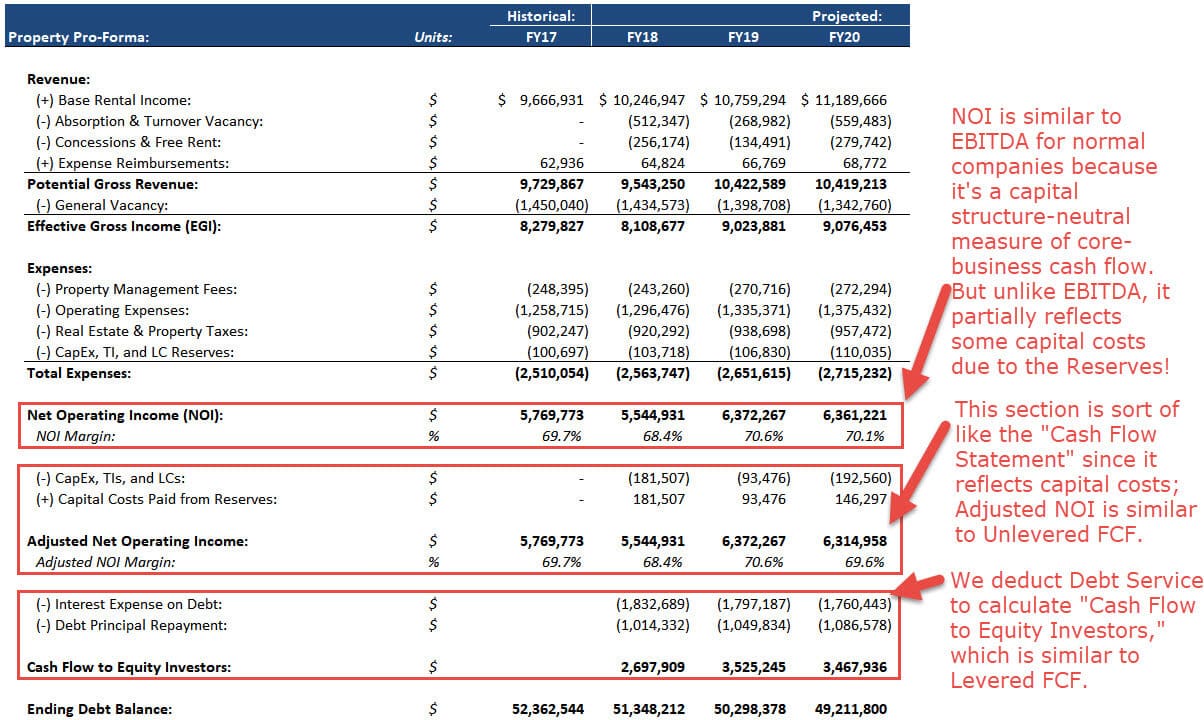

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

What is the Illinois estate tax. The average annual growth for property taxes was 46 percent versus 42 percent for state gross domestic product or 41 percent for state personal income which are two similar measurements of. This means that if the value of your estate is less than 545 million federal estate tax will not apply to you. A real estate assessment is the fair-cash value placed on real property by the tax assessor. Senate Bill 689 repeals the Illinois Estate and Generation Skipping Transfer Tax for persons dying on or after July 1 2021 and for gifts made on or after July 1 2021.

Source: cityofpowell.us

Source: cityofpowell.us

2005 Illinois 35 ILCS 200 Property Tax Code. The chart show below can be used to find out just how much taxes would be owed on a particular estate. Article 8 - Department Of Revenue. Tax Rate under the Illinois Real Estate Transfer Tax Law The tax rate under the Illinois Real Estate Transfer Tax Law is 050 for each 500 of value or fraction of 500 stated in the declaration required by the transfer declaration under section 31-25. Sets forth a schedule of income-based tax rates for individuals trusts and estates for taxable years beginning on or after January 1 2021.

Source: in.pinterest.com

Source: in.pinterest.com

Article 1 - Short Title And Definitions. This value is used to determine the proper tax that will be imposed on that property wwwrevenuestateilustaxinformation. The Department issues guidelines determines county. Article 8 - Department Of Revenue. Illinois Estate Tax Rate The Illinois estate tax rate is graduated with a top rate of 16 percent.

Source: pinterest.com

Source: pinterest.com

They propose that will stay in place for the next 30 years. It is a tax assessed on the assets you own at the time of your death less the debts and expenses related to your estate. Sales begin at 900 am and all of the delinquent taxes are offered for sale both separately and in consecutive order. Who does the Illinois estate tax apply to. What they fail to recognize is that property taxes are a net loser for they are never considered as a cost when you sell your home.

Source: pinterest.com

Source: pinterest.com

Article 1 - Short Title And Definitions. Article 1 - Short Title And Definitions. Provides that for taxable years beginning on or after January 1 2021 the tax on corporations shall be imposed at the rate of 799 of the taxpayers net income for the taxable year. A real estate assessment is the fair-cash value placed on real property by the tax assessor. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Source: northcentralillinois.org

Source: northcentralillinois.org

It is a tax assessed on the assets you own at the time of your death less the debts and expenses related to your estate. What they fail to recognize is that property taxes are a net loser for they are never considered as a cost when you sell your home. Provides that for taxable years beginning on or after January 1 2021 the tax on corporations shall be imposed at the rate of 799 of the taxpayers net income for the taxable year. Article 1 - Short Title And Definitions. Title 1 - General.

Source: pinterest.com

Source: pinterest.com

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. How does the Illinois estate tax differ from the federal estate tax. The fair-cash value of a property is based on its highest and best use as of the date of the assessment. Change your name and mailing address. Revenues from proprty etax are collected and spent at the local level.

Source: civicfed.org

Source: civicfed.org

A tax is imposed on the privilege of transferring title to real estate located in Illinois on the privilege of transferring a beneficial interest in real property located in Illinois and on the privilege of transferring a controlling interest in a real estate entity owning property located in Illinois at the rate of 50 for each 500 of value or fraction of 500 stated in the declaration required by Section 31-25. Property tax is governed by the Property Tax Code 35 ILCS 2001 -1 through 32 20. What is the Illinois estate tax. If however the deed or trust document states that the real estate is. It is a tax assessed on the assets you own at the time of your death less the debts and expenses related to your estate.

Source: wealthfit.com

Source: wealthfit.com

Remember that in Illinois you pay taxes on the entire estate if it is above the 4 million threshold. Illinois Estate Tax Rate The Illinois estate tax rate is graduated with a top rate of 16 percent. In some areas this figure can be upwards of 6000 per year. Who does the Illinois estate tax apply to. The average annual growth for property taxes was 46 percent versus 42 percent for state gross domestic product or 41 percent for state personal income which are two similar measurements of.

Source: crowdreason.com

Source: crowdreason.com

The Fed is proposing a 1 annual tax be imposed already on top of the highest property taxes in the country. Illinois provides a chart that establishes base taxes to be paid a marginal tax rate and a rate threshold for taxable estates. How does the Illinois estate tax differ from the federal estate tax. Senate Bill 689 repeals the Illinois Estate and Generation Skipping Transfer Tax for persons dying on or after July 1 2021 and for gifts made on or after July 1 2021. Residents of Illinois with estates over 4 million.

2005 Illinois 35 ILCS 200 Property Tax Code. How to Avoid Estate Tax. The annual tax sale in 2020 will be held on November 17th. The statewide average effective tax rate is 216 nearly double the national average. See if you are eligible for 46 million in missing tax exemptions.

Source: anmtg.com

Source: anmtg.com

If however the deed or trust document states that the real estate is. Property tax in Illinois is imposed by local government taxing districts eg school districts municipalities counties and administered by local officials. What they fail to recognize is that property taxes are a net loser for they are never considered as a cost when you sell your home. Property tax is governed by the Property Tax Code 35 ILCS 2001 -1 through 32 20. Illinois provides a chart that establishes base taxes to be paid a marginal tax rate and a rate threshold for taxable estates.

Source: pinterest.com

Source: pinterest.com

What is the Illinois estate tax. How to Avoid Estate Tax. This means that if the value of your estate is less than 545 million federal estate tax will not apply to you. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. The annual tax sale in 2020 will be held on November 17th.

Source: realtor.com

Source: realtor.com

If however the deed or trust document states that the real estate is. How does the Illinois estate tax differ from the federal estate tax. If however the deed or trust document states that the real estate is. The fair-cash value of a property is based on its highest and best use as of the date of the assessment. Title 2 - Assessment Officials.

Source: crowdreason.com

Source: crowdreason.com

1 days ago Tax amount varies by county The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Article 6 - Boards Of Review. Article 4 - Assessment Officials - Other Provisions. Senate Bill 689 repeals the Illinois Estate and Generation Skipping Transfer Tax for persons dying on or after July 1 2021 and for gifts made on or after July 1 2021. Illinois provides a chart that establishes base taxes to be paid a marginal tax rate and a rate threshold for taxable estates.

Source: br.pinterest.com

Source: br.pinterest.com

Title 1 - General. A real estate assessment is the fair-cash value placed on real property by the tax assessor. Article 7 - Property Tax Appeal Board. If the value of your estate is 645 million only 1 million will be taxable on the federal level I use the word only loosely. 2005 Illinois 35 ILCS 200 Property Tax Code.

Source: pinterest.com

Source: pinterest.com

Article 5 - Boards Of Appeals. Property tax is governed by the Property Tax Code 35 ILCS 2001 -1 through 32 20. Article 3 - County Assessment Officials. Article 5 - Boards Of Appeals. The Department issues guidelines determines county.

Source: pinterest.com

Source: pinterest.com

How does the Illinois estate tax differ from the federal estate tax. They propose that will stay in place for the next 30 years. The average annual growth for property taxes was 46 percent versus 42 percent for state gross domestic product or 41 percent for state personal income which are two similar measurements of. The chart show below can be used to find out just how much taxes would be owed on a particular estate. Article 8 - Department Of Revenue.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1 annual real estate tax illinois by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.